The Ultimate Guide To Estate Planning Attorney

Table of ContentsGetting My Estate Planning Attorney To WorkSome Of Estate Planning AttorneyEstate Planning Attorney Can Be Fun For AnyoneGetting My Estate Planning Attorney To Work

Your attorney will additionally aid you make your files official, setting up for witnesses and notary public trademarks as necessary, so you don't have to fret about attempting to do that last step on your own - Estate Planning Attorney. Last, yet not least, there is important tranquility of mind in developing a partnership with an estate preparation attorney that can be there for you in the futurePut simply, estate planning attorneys give worth in numerous ways, much past simply providing you with printed wills, counts on, or other estate planning files. If you have inquiries concerning the procedure and wish to find out more, call our office today.

An estate preparation lawyer aids you define end-of-life decisions and lawful files. They can establish up wills, develop trusts, develop healthcare directives, establish power of attorney, produce sequence plans, and much more, according to your desires. Collaborating with an estate planning attorney to complete and manage this legal paperwork can help you in the following 8 locations: Estate intending attorneys are professionals in your state's count on, probate, and tax obligation laws.

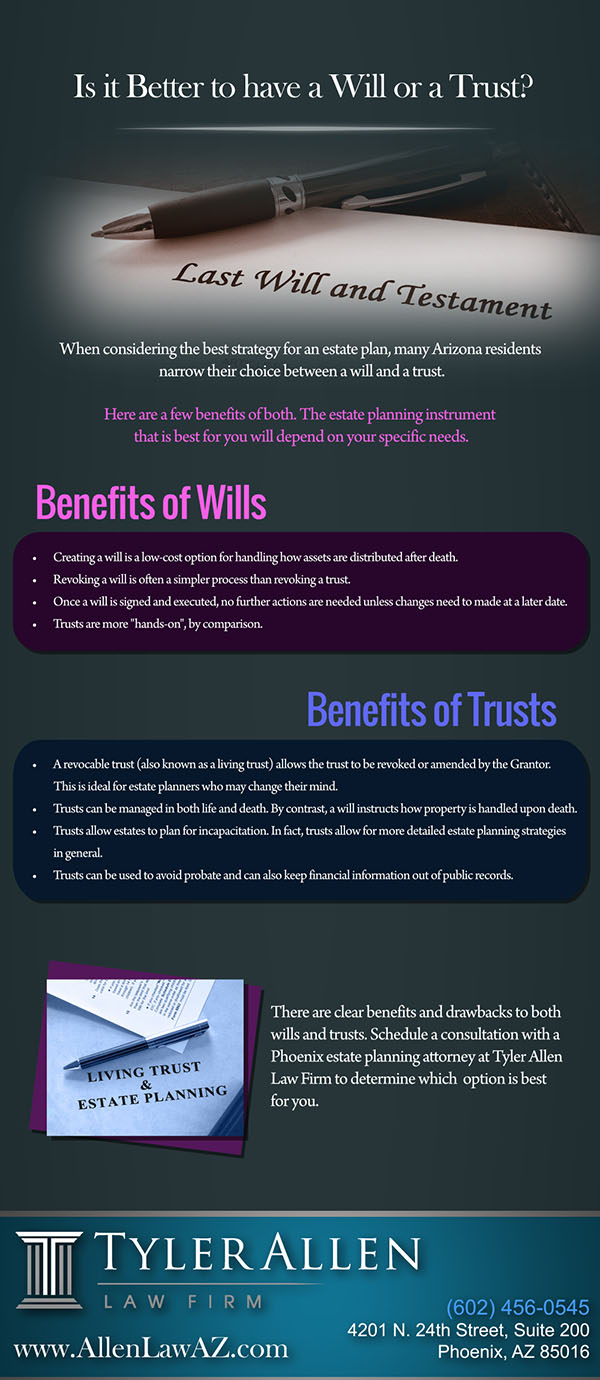

If you don't have a will, the state can determine just how to split your possessions among your beneficiaries, which may not be according to your desires. An estate preparation attorney can assist organize all your lawful files and distribute your assets as you want, possibly staying clear of probate. Lots of people compose estate preparation papers and then forget them.

The Of Estate Planning Attorney

As soon as a client passes away, an estate strategy would determine the dispersal of properties per the deceased's directions. Estate Planning Attorney. Without an estate plan, these choices may be entrusted to the next of kin or the state. Obligations of estate organizers include: Creating a last will and testimony Establishing trust fund accounts Naming an executor and power of lawyers Recognizing all beneficiaries Naming a guardian for small children Paying all financial obligations and reducing all tax obligations and legal fees Crafting guidelines for passing your worths Developing preferences for funeral setups Settling instructions for treatment if you come to be ill and are unable to choose Getting life insurance policy, impairment earnings insurance coverage, and long-term care insurance policy A great estate plan must be updated on a regular basis as customers' financial circumstances, individual inspirations, and federal and state regulations all advance

Similar to any kind of career, there are features and abilities that can assist you attain these goals as you deal with your customers in an estate organizer role. An estate preparation career can be appropriate for you if you possess the following characteristics: Being an estate planner indicates believing in the long-term.

Estate Planning Attorney Fundamentals Explained

You should aid your customer expect his/her end of life and what will happen postmortem, while at the same time not home on morbid ideas or feelings. Some customers may become bitter or troubled when considering death and it could be up to you to help them with it.

In the occasion of death, you may be anticipated to have countless discussions and negotiations with making it through family participants about the estate plan. In order to succeed as an estate coordinator, you might need to stroll a great line of being a shoulder to lean on and the private relied on to communicate estate preparation matters in a prompt and expert fashion.

tax code changed countless times in the one decade between 2001 and 2012. Anticipate that it has actually been altered further ever since. Relying on your client's monetary earnings bracket, which may evolve towards end-of-life, you as an estate coordinator will certainly have to maintain your client's properties in complete lawful conformity with any kind of neighborhood, government, or worldwide tax regulations.

Not known Factual Statements About Estate Planning Attorney

Getting this accreditation from organizations like the National Institute of Certified Estate Planners, Inc. can be a strong differentiator. Belonging to these professional groups can verify your skills, making you more appealing in the eyes of a prospective customer. In addition to the psychological benefit helpful customers with end-of-life preparation, estate organizers appreciate the advantages of a secure income.

Estate preparation is a smart thing to do despite your existing wellness and financial status. However, not so lots of individuals know where to begin the process. The first vital thing is to work with an estate planning attorney to help you with it. The adhering to are five advantages of dealing with an estate planning attorney.

The portion of people who do not recognize just how to obtain a will has increased from 4% to 7.6% click reference since 2017. A skilled attorney knows what information to consist of in the will, including your beneficiaries and special factors to consider. A will shields your family from loss due to the fact that of immaturity or incompetency. It likewise supplies the swiftest and most reliable approach to move your properties to your beneficiaries.